Wells Fargo Balance Transfer Once Can I Do It Again?

A Complete Wells Fargo Rest Transfer Guide

by Lyle Daly | Updated Sept. 17, 2021 - Start published on December. 24, 2018

Prototype source: Getty Images

Consolidating your credit menu debt can be a big money-saver. If you're trying to pick the correct one, our Wells Fargo rest transfer guide has you covered. Image source: Getty Images.

Consolidating your credit card debt can be a large money-saver. If you lot're trying to pick the right 1, our Wells Fargo balance transfer guide has you lot covered.

Wells Fargo may not be the biggest credit carte issuer, just one area where it excels is residuum transfer offers. Some of the best Wells Fargo cards accept 0% intro APRs, and if you're dealing with credit card debt, that intro APR can give you an opportunity to pay it down without racking upward more involvement charges.

When you're fix to transfer your debt, you'll find everything you need to know in this Wells Fargo balance transfer guide, including the card issuer's rules, how to do a transfer, and the right cards for the job.

Remainder transfer rules with Wells Fargo

Earlier you lot transfer a residue to your Wells Fargo credit card, you lot should know about the rules and fees involved.

Qualifying for the intro Apr:

- For Wells Fargo credit cards that offer an intro April on balance transfers, this APR will simply apply to balances that you transfer within the showtime 120 days.

- Yous may non exist eligible for a 0% intro APR offer on a Wells Fargo card if you lot've already gotten any sort of welcome offer on some other Wells Fargo carte inside the previous fifteen months. Welcome offers can include sign-up bonuses and low or 0% Apr intro periods.

- The top balance transfer cards usually require at to the lowest degree a good credit score for approval, so you should accept a score of 670 or higher if you desire the best chance of qualifying.

Types of debt you can transfer:

- Wells Fargo allows you to transfer just near every type of debt to one of its balance transfer cards, including credit card balances, personal loans, motorcar loans, and home disinterestedness loans. Yous tin but transfer credit card balances online, though, and the rest must be done by telephone.

- Like every other bank, Wells Fargo doesn't let transfers from accounts with itself or whatsoever of its affiliates to one of its balance transfer cards. For example, you couldn't transfer a Wells Fargo auto loan remainder to a Wells Fargo credit carte.

Balance transfer fees:

- The introductory remainder transfer fee is $5 or 3% of the amount transferred, whichever is greater. This intro fee applies to balances transferred within the beginning 120 days.

- Subsequently that 120 days, the residuum transfer fee is $5 or 5% of the corporeality transferred, whichever is greater.

Transfer limits:

- You must take enough available credit after your transfer to cover the balance transfer fee. For example, if you have a $10,000 credit limit and it's all available for use, you could transfer up to $ix,700 during the first 120 days, equally you'd need $300 to cover the 3% fee.

Rewards:

- You tin't earn any cash dorsum or points on balance transfers.

- Balance transfers don't help yous run across the spending minimum on a sign-upwards bonus.

How to do a residual transfer with Wells Fargo

If you take your Wells Fargo card already and you're transferring credit bill of fare balances, then you can do a balance transfer online. Hither'due south how:

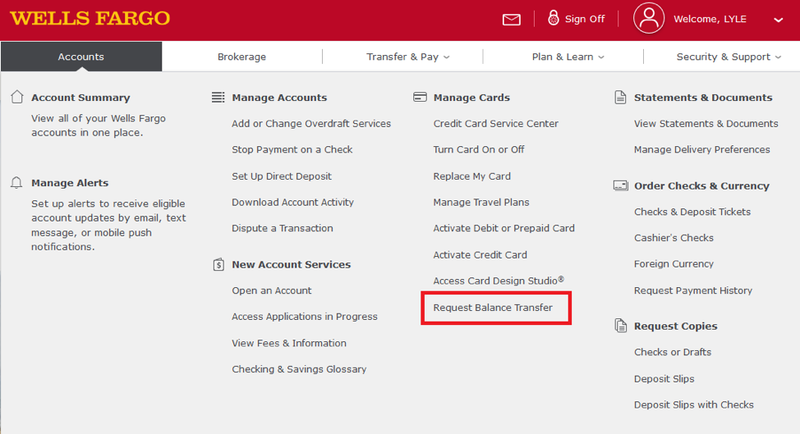

i. Log in to your Wells Fargo account.

2. Place the cursor over "Accounts," and and so click "Request Rest Transfer" on the drop-down menu that appears.

Epitome source: Getty Images

- Fill out the balance transfer form with the creditor names, account numbers, and the amounts you wish to transfer from each of those accounts.

In example you're wondering about whatsoever of these, here is what you lot would put for each:

- Creditor proper noun -- The name of the card issuer, such as American Limited or Chase.

- Account number -- The credit bill of fare number of the card with the remainder.

- Amount -- The amount to transfer over, which must be at to the lowest degree $100.

- One time you've entered all the required information, submit the transfer.

Alternate residue transfer options

You tin also submit your residual transfer over the phone past calling Wells Fargo at one-800-400-9423. Y'all'll need to call to transfer whatever type of debt also a credit card balance.

If you lot don't have a Wells Fargo card yet, you can request your balance transfer during the application process. The application asks yous whether you desire to transfer a balance.

Making the most of a residual transfer

A balance transfer isn't a silver bullet guaranteed to destroy your credit card debt. In fact, plenty of consumers waste material this opportunity past relaxing once they have a 0% intro APR. To ensure that y'all make legitimate progress, follow these steps with your residue transfer:

- Summate how much money you can pay towards your credit card debt per month.

- Effigy out how long it volition have yous to repay your debt.

- Choose the Wells Fargo rest transfer card with an intro menstruum that fits your debt repayment timeline. If you expect repayment to take longer than 18 months, go with the Wells Fargo Platinum Visa menu.

- Transfer your balances within the first 120 days to lock in the intro APR and pay the lower residue transfer fee.

- Brand your payments on time every calendar month and avoid putting more than purchases on the carte du jour until y'all've paid off your debt.

- Use a balance transfer calculator to see how much y'all'll salvage by transferring your balance to a new card.

Top credit card wipes out involvement into belatedly 2023

If you have credit menu debt, transferring information technology tothis acme remainder transfer carte secures you a 0% intro APR into late 2023! Plus, you'll pay no annual fee. Those are just a few reasons why our experts rate this menu equally a elevation selection to assistance go control of your debt.Read The Ascent's total review for free and utilize in just 2 minutes.

About the Writer

Lyle is a author specializing in credit cards, travel rewards programs, and banking. His work has also appeared on MSN Coin, USA Today, and Yahoo! Finance.

Featured Articles

Source: https://www.fool.com/the-ascent/credit-cards/articles/a-complete-wells-fargo-balance-transfer-guide/

0 Response to "Wells Fargo Balance Transfer Once Can I Do It Again?"

Post a Comment